The

Critical Role of Taiwan in the United States Semiconductor Supply Chain

PDF Version

By: YiTan

Hsu | Nov 24th 2024

Introduction

to Semiconductors

In June, NVIDIA,

Advanced Micro Devices (AMD), and Intel each launched their next generation of

artificial intelligence (AI) chips in Taiwan (CNN Business 2024)[1]. These global tech giants are focused on

advancing AI through cutting-edge hardware, software, and systems. During

NVIDIA CEO Jensen Huang’s keynote at COMPUTEX 2024, a closing video highlighted

Taiwan’s crucial role in realizing this vision: "It’s Taiwan that helped

us realize a vision. Countless partners lifted us every step of this long

journey, from accelerated computing, computer graphics, and scientific research

to AI. Every chip and every computer described stories of hard work and the

pursuit of perfection. You are the unsung heroes, the pillars of the

world."[2] This underscored Taiwan’s significance in the

advanced technology industry. The gathering of three major Silicon Valley

companies on this relatively small island raised curiosity, but their primary

purpose was to meet with key business partners, particularly Taiwan

Semiconductor Manufacturing Company (TSMC), a critical player in the global

semiconductor supply chain.

During the COVID-19

pandemic, many countries were on lockdown. It seriously impacted different

industries, people could not move around freely and businesses were

closed-down. The semiconductor industry was also facing challenges in this

period. As Mohammad mentions since 2020, there has been a major supply shortage

of semiconductors across the world.[4] The authors also point out that this shortage

crisis not only affected consumer products such as computers, the smartphone

industry, the healthcare sector, and automotive but also government use. It

took more time for people to get the technology items they needed and delayed

the schedule of the governments that needed their defense weapons. The

challenges faced during the pandemic underscored the critical importance of a

resilient and efficient semiconductor supply chain, revealing its centrality to

both everyday life and national security. The semiconductor industry’s

significance transcends its immediate role in electronic devices. It is a

cornerstone of innovation, economic strength, and national security. The

lessons from the challenges posed by the COVID-19 pandemic emphasize the need

for a robust and adaptable semiconductor supply chain. As looking to the

future, the continued evolution of the semiconductor industry will be

instrumental in defining the technological landscape, economic fortunes, and geopolitical

standings of nations worldwide. Hence, securing and advancing semiconductor

capabilities is not only a matter of industrial importance but a strategic

imperative for the progress and resilience of contemporary society.

Semiconductor

chips are adopted in almost all electronic devices. Semiconductors are

important components in a variety of consumer products such as computers,

smartphones, and automobiles. Besides, semiconductors can also be applied for

military and civilian use. For example, the U.S. Department of Defense’s (DOD)

objective to ensure continued warfighting advantage over adversaries via

technological dominance often requires the integration of leading-edge

components (Mohammad et al. 2022).[5]

The DOD has a high demand for semiconductors to apply to military applications

from ships, planes, tanks, long-range munitions, radar and communication gear

to night vision, satellites, and sensors. The tension between economic gain and

security risk inherent within dual-use semiconductor goods is heightened in

fields with national security implications, such as supercomputing and

artificial intelligence (Reinsch et al. 2022).[6]

With their wide range of uses, semiconductors have evolved into a continuous

competition that extends beyond the boundaries of private enterprises,

involving entire nations. This ongoing rivalry is driven not just by the

pursuit of technological advancements in the private sector but also by the

strategic interests and capabilities of countries on the global stage. The

competition involves a multifaceted interplay of economic proficiency,

technological innovation, and geopolitical influence, shaping the landscape of

semiconductor development and utilization in the global stage.

Overview

of the Semiconductor Supply Chain

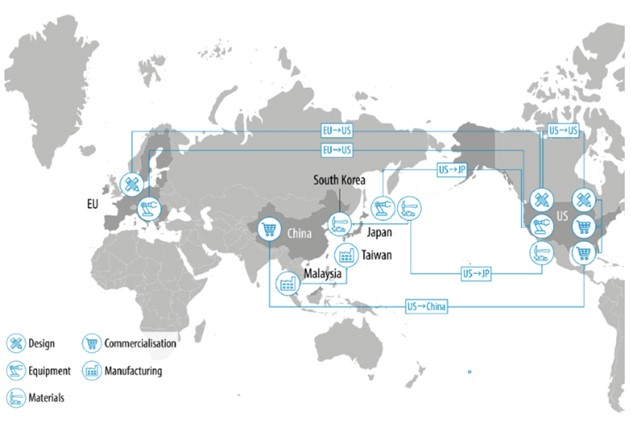

As Reinsch et al.

mention that the complex dynamics of the global semiconductor supply chain can

be introduced in three parts: Research and Development (R&D) encompassing

chip design, fabrication involving chip production, and advanced testing and packaging

constituting the back-end manufacturing process.[7] In particular, the central components

navigating this complex network are the United States, Taiwan, South Korea,

Japan, Europe, and China. The United States and Europe, boasting highly skilled

workforces, assume pivotal roles in the innovative domain of semiconductor

production, specifically contributing to the chip design phase. South Korea and

Taiwan have carved out niches in original equipment manufacturing and play

essential roles in chip production, while Japan focuses on supplying

specialized materials and equipment critical to the semiconductor industry.

Meanwhile, China leverages its comparative advantage in lower labor costs,

primarily influencing the packaging stages of the supply chain. It is also

strong in the legacy chips. According to Mohammad et al., in 2021, the major

top chip design companies relied on the Asia Pacific region for semiconductor

manufacturing. Together, the two largest chip producers, TSMC (Taiwan) and

Samsung (South Korea), dominate more than 70% of global semiconductor production.

By 2020, Taiwan and South Korea comprised the majority of total semiconductor

contract manufacturing. Furthermore, China and Taiwan collectively contribute

over 60% of the world’s capacity for assembly, packaging, and testing. This

collaborative organization among nations underscores a strategic division of

labor, corresponding to their distinct strengths and collectively propelling

the evolution and achievement of the global semiconductor industry.[8]

Taiwan’s

Semiconductor Development

Despite

its small size, Taiwan boasts a robust and resource-rich semiconductor

industry. Hsinchu Science Park, located in northern Taiwan, was established by

the government and brings together various private sector players. This area

houses a significant portion of the advanced technology resources and

expertise, and it attracts a pool of highly skilled engineers. TSMC, the

world’s leading semiconductor foundry, has its headquarters in this science

park. The collaboration between the government, private sector, and Taiwan’s

unique development model has made the island a key player in the global chip

industry. In 2023, TSMC’s revenue represented nearly 1% of Taiwan’s GDP. Recent

reports from Trendforce reveal significant figures related to TSMC. Following

an exclusive interview with President Donald Trump published by Bloomberg, the

Nasdaq Composite Index fell by 2.8% on July 17th, resulting in a collective

loss of approximately $700 billion in market value among major semiconductor

stocks, including TSMC and the seven largest U.S. tech giants. According to the

Semiconductor Industry Association, TSMC produces 92% of the world’s advanced

semiconductors, while South Korea accounts for the remaining 8%. TSMC is proud

to be the world’s first dedicated semiconductor foundry, exclusively

manufacturing chips for companies that do not produce their own. Major clients,

including NVIDIA, AMD, Broadcom, and Qualcomm, depend on TSMC as a key

supplier. Moreover, NVIDIA and other companies purchase chips from TSMC to

resell, with about 45% of NVIDIA’s sales coming from large firms such as

Microsoft, Meta, Alphabet, Amazon, and Tesla. Although Apple currently sources

fewer chips from NVIDIA, it represents approximately 27% of Qualcomm’s sales

and 17% of Broadcom’s sales. In summary, without TSMC, essential products like

the iPhone and AI servers—integral to modern life—would not exist. Tae Kim, a

technology journalist at Barron’s, has described the potential risks of

disruptions in TSMC’s operations as a “Global Depression.” [10]

When

discussing the semiconductor industry, South Korea and Taiwan are often

mentioned together. During the 1970s and 1980s, South Korea and Taiwan, as part

of the Newly Industrialized Countries (NICs), ventured into the semiconductor

industry. To prevent the rise of additional potential competitors in the

semiconductor sector, the United States limited its collaboration with South

Korea and Taiwan and strengthened its partnership with Japan. U.S changed its

stances in the 1990s to support these and exclude Japan, a competitor. However,

through the strategy of their business structures and government support, both

South Korea and Taiwan have effectively secured and fortified their notable

positions in the contemporary semiconductor industry. This success reflects a

combination of business insight, technological innovation, and proactive

government policies that have promoted these nations into significant roles

within the highly competitive and rapidly advancing semiconductor landscape.

Although

South Korea and Taiwan share similarities in their semiconductor industries,

their economic structures have led to distinct approaches to business

development. Taiwan’s economy has been constructed on the foundation of small-

and medium-sized, family-owned businesses. As Newburry mentions, Taiwanese

workers usually stay with the company until they gain enough knowledge and

capital. It also makes the business market competitive and intense.[12]

However, due to this phenomenon, companies in Taiwan cultivated the ability to

respond swiftly to changes in the market. This positive outcome has contributed

to Taiwan establishing a crucial role in the field of manufacturing. The

Taiwanese government played a strong role in developing the Taiwanese

semiconductor industry.[13] As a globally valuable semiconductor company,

TSMC is a good example. TSMC was founded in 1987 and its headquarters was

located in Hsinchu, Taiwan. It was a government program in the beginning and

led by Morris Chang. The Taiwanese government had established public research

institutes for future technology and innovation and created a specific area

with special tax subsidies to support the development of technology.[14] Besides the strong skill of original

equipment manufacturers (OEM) of Taiwanese companies, the government engaged in

cultivating talented and high-skill specialists to help the local semiconductor

industry. It makes Taiwan an invaluable part of the semiconductor supply chain.

These days, TSMC not only does the OEM task but also helps customers generate

chipsets and assists with better designs.

As

Wylegala mentions the United States and Taiwan have built a complementary and

interdependent economic relationship in the past few decades.[15] The United States is the second largest trade

partner of Taiwan, and one-third of the goods it imports from Taiwan are

Information and Communications Technology (ICT) related products.[16] The United States exhibits a substantial

demand for semiconductor chips sourced from Taiwan. Prominent U.S. technology

firms, including NVIDIA, Qualcomm, and even the DOD, rely on TSMC as their

supplier. Furthermore, under the Creating Helpful Incentives to Produce

Semiconductors (CHIPS) and Science Act, signed into law by President Joe Biden

on August 9, 2022, the U.S. encourages increased investment from Taiwan. This

act allocates approximately $280 billion over 10 years to strengthen domestic

semiconductor research and manufacturing.[17] In April 2024, TSMC announced it had signed a

preliminary memorandum with the U.S. Department of Commerce to receive up to

$6.6 billion in funding under the CHIPS Act. This funding will support TSMC’s

plan to build a third semiconductor fab in Arizona to meet rising demand,

bringing the company’s total investment in Arizona to over $65 billion—the

largest foreign direct investment in the state’s history. The three fabs are

expected to create 6,000 high-tech jobs and 20,000 construction jobs,

bolstering the U.S. semiconductor ecosystem. The first fab in Arizona will

start producing 4nm chips in 2025. The second fab, scheduled to open in 2028,

will produce advanced 2nm and 3nm technology, while the third fab will

manufacture chips with 2nm or more advanced processes by the decade’s end. TSMC

prioritizes green manufacturing practices, targeting a 90% water recycling rate

and near-zero liquid discharge through an industrial water reclamation plant.

Additionally, TSMC is seeking $5 billion in loans and up to 25% in tax credits

on qualified capital expenditures. The company aims for 15-20% annual revenue

growth, a gross margin of at least 53%, and a return on equity (ROE) of 25% or

higher.[18] Nevertheless, given the complex and intense

geopolitical situation, Taiwan faces a delicate challenge in managing its

relationship with both the United States and China. Navigating this intricate

balance requires thoughtful consideration of political sensitivities, economic

interests, and regional dynamics to ensure a prudent and strategic approach.

Future

Challenges

Despite

Taiwan’s crucial position in the semiconductor industry, it faces several

challenges. One key strategy is to maintain strong relationships with partners

and uphold existing agreements. Under the CHIPS and Science Act, the United

States restricted the export of advanced chips to China and directed tech

giants like TSMC and Samsung not to produce these high-end chips within China.

Although China raised objections and filed a complaint with the World Trade

Organization (WTO), arguing that the U.S. had breached fair trade practices,

its options for recourse were limited. In response, the Chinese government has

increased support for its domestic semiconductor industry, emphasizing

innovation and boosting investment in the local market. Given China’s importance

as a major market, those tech companies must navigate trade carefully to avoid

violating U.S. regulations. Additionally, with the new U.S. administration, the

CHIPS and Science Act could undergo changes. According to DIGITIMES Asia,

concerns have emerged regarding the impact of Donald Trump’s return to the

White House on Taiwanese semiconductor suppliers. Macronix International CEO

Miin Wu noted that TSMC may be pressured to replicate its most advanced

semiconductor processes in the U.S., as Taiwan faces limited options under

international pressure. The leadership shift could also lead to changes in

subsidies and tariffs under the CHIPS Act. Wu emphasized that the impact will

depend on how the U.S. adjusts its policies. While the CHIPS Act is already in

place, new terms or tariffs could be introduced, compelling companies to comply

with U.S. policies and potentially establish manufacturing within the U.S.[19]

On

the other hand, competition is intense, particularly from South Korea, which

has established a significant role in the semiconductor supply chain.

Meanwhile, India is emerging as a rising player in this sector. With government

investments and a close relationship with the United States, India may

eventually develop into a strong competitor in the semiconductor industry, even

if it takes time. Additionally, the Taiwan Strait issue poses a persistent

threat to the island. Geopolitical risks have heightened uncertainty in the

region. Since 2023, TSMC has expanded its factories on the island to increase

production capacity. In February 2024, the Japan Advanced Semiconductor

Manufacturing facility in Kumamoto began operations as TSMC’s first overseas

branch. Currently, TSMC is also constructing factories in Arizona, United

States, and Dresden, Germany, and plans to collaborate with the Czech Republic.

These efforts not only aim to boost production but also to enhance TSMC’s

status in the global market, thereby mitigating geopolitical risks.

Author’s Biography

YiTan Hsu is

a master’s student at the Graduate School of International Studies, Korea

University, specializing in International Commerce. Her research interests

include international business strategy, geopolitics, and public diplomacy.

The author thanks Brendan Donnelly & Dr. Indu Saxena for their extensive feedback and review.

References

[1] Chang, W., and L. He. "Tech Giants Unveil Next Generation AI Chips in Taiwan as Competition Heats Up." CNN Business, June 4, 2024. https://edition.cnn.com/2024/06/03/tech/nvidia-amd-ai-tech-computex-taiwan-intl-hnk/index.html.

[2] Huang, J. "NVIDIA CEO Jensen Huang Keynote at COMPUTEX 2024." YouTube, June 4, 2024. https://www.youtube.com/watch?v=pKXDVsWZmUU.

[3] Sisley. "Computex 2024 黃仁勳台大演講:台灣是 AI 產業革新的後盾,謝謝你!" INSIDE, June 2, 2024. https://www.inside.com.tw/article/35201-nvidia-jensen-keynote-2024-computex.

[4] Mohammad, W., A. Elomri, and L.

Kerbache. "The Global Semiconductor Chip Shortage: Causes, Implications,

and Potential Remedies." IFAC-PapersOnLine 55, no. 10 (2022): 476–483. https://doi.org/10.1016/j.ifacol.2022.09.439.

[5] Ibid

[6] Reinsch, W. A., E. Benson, and A.

Arasasingham. "Securing Semiconductor Supply Chains: An Affirmative Agenda

for International Cooperation." Center for Strategic and International

Studies (CSIS), 2022. http://www.jstor.org/stable/resrep42770

[7] Ibid

[8] ibid

[9]

Kjeld van Wieringen.

"Strengthening EU Chip Capabilities: How Will the Chips Act Reinforce

Europe’s Semiconductor Sector by 2030?" European Parliament Think Tank,

July 2022.

https://www.europarl.europa.eu/RegData/etudes/BRIE/2022/733585/EPRS_BRI(2022)733585_EN.pdf.

[10] TrendForce News. "Decipher TSMC in Key Figures: Some Facts Needed to Be Known." Accessed July 23, 2024. https://www.trendforce.com/news/2024/07/23/news-decipher-tsmc-in-key-figures-some-facts-needed-to-be-known/.

[11] Cable News Network. "TSMC Says

Skilled Worker Shortage Delays Start of Arizona Chip Production | CNN

Business." CNN, July 21, 2023. https://edition.cnn.com/2023/07/21/tech/tsmc-arizona-production-delay/index.html.

[12] Newburry, W. E. "The

Semiconductor Industries in Taiwan and South Korea." Journal of Third

World Studies 9, no. 2 (1992): 154–181. http://www.jstor.org/stable/45197257.

[13] Ibid

[14]

Chen, J. H., and T. S. Jan.

"A System Dynamics Model of the Semiconductor Industry Development in

Taiwan." The Journal of the Operational Research Society 56, no. 10

(2005): 1141–1150. http://www.jstor.org/stable/4102231.

[15] Wylegala, A. "Expanding the

Depth and Breadth of the US-Taiwan Technological Partnership via the

Semiconductor Ecosystem." East-West Center, 2022. http://www.jstor.org/stable/resrep42163.

[16] Ibid.

[17] Taylor, M. "The US CHIPS and

Science Act of 2022." MRS Bulletin 48, no. 9 (2023): 874–879. https://doi.org/10.1557/s43577-023-00581-w

[18] "TSMC Arizona and U.S.

Department of Commerce Announce up to US$6.6 Billion in Proposed CHIPS Act

Direct Funding, the Company Plans Third Leading-Edge Fab in Phoenix." TSMC

Newsroom, https://pr.tsmc.com/english/news/3122.

[19] Siu Han, T. J. H. "TSMC Poised to Expand Advanced Chips Production in the US During Trump’s Second Term." DIGITIMES, November 11, 2024. https://www.digitimes.com/news/a20241108PD215/tsmc-donald-trump-taiwan-technology-production.html